What is Stamp Duty?

What is buyer stamp duty and additional buyer stamp duty in Singapore? Before we talked about that, let us have a brief definition of the meaning of a Stamp Duty. Stamp duty is a tax on documents relating to the purchase or lease of a property. Within 14 days after the date of the document (e.g. Sale & Purchase Agreement, Tenancy Agreement), the buyer has to pay it. In the case that the document is signed overseas, it has to be paid within 30 days after the date of its receipt in Singapore.

It is not only an offence to use a document which Stamp Duty has not been paid on, it is also important to note that only a document where Stamp Duty is paid can be admitted as evidence in the court in cases of disagreements.

What is Buyer’s Stamp Duty?

(Note: Buyer’s Stamp Duty was last revised on 20 Feb 2018)

Buyer’s Stamp Duty is tax paid on the acceptance of Option to Purchase (OTP) / Sale & Purchase Agreements (S&P). When you buy or sell your property, there are documents (i.e. OTP or S&P) that are prepared. Stamp Duty is payable on the actual price or market price whichever is higher. The buyer is responsible for paying Buyer’s Stamp Duty. Where Seller’s Stamp Duty is applicable, the seller is responsible for paying Seller’s Stamp Duty.

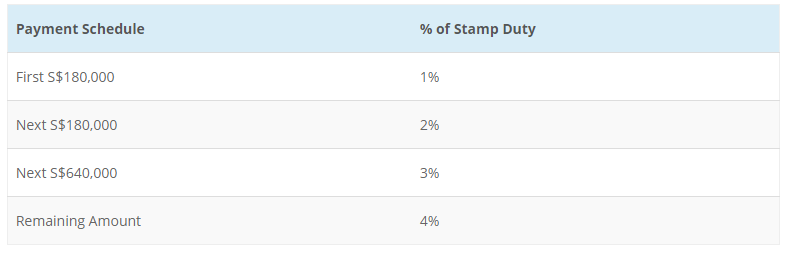

Calculation of Buyer’s Stamp Duty:

PAYMENT SCHEDULE OF STAMP DUTY

What is Additional Buyer’s Stamp Duty?

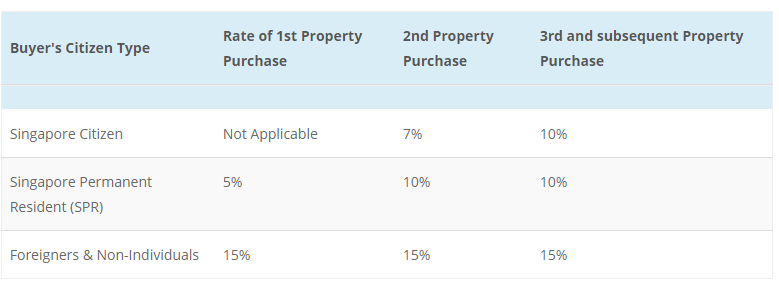

On 7 December 2011, Additional Buyer’s Stamp Duty (ABSD) was first introduced to cool the residential market and revised upwards on 12 Jan 2013 due to the further acceleration in the escalation of the price of the residential properties. Certain groups of people who buy or acquire residential properties (including residential land) on top of the existing buyer’s stamp duty (BSD) have the responsibility to pay ABSD. ABSD is applicable as follows:

Rates on or before 5 July 2018

Note: There will be a transitional provision for cases where an Option to Purchase (OTP) has been granted by sellers to potential buyers on or before 5 July 2018, and this OTP has not been varied on or after 6 July 2018. For such cases, the current ABSD rates, instead of the revised ABSD rates, will apply if the OTP is exercised within 3 weeks of this announcement (i.e. exercised on or before 26 July 2018) or the OTP validity period, whichever is earlier.

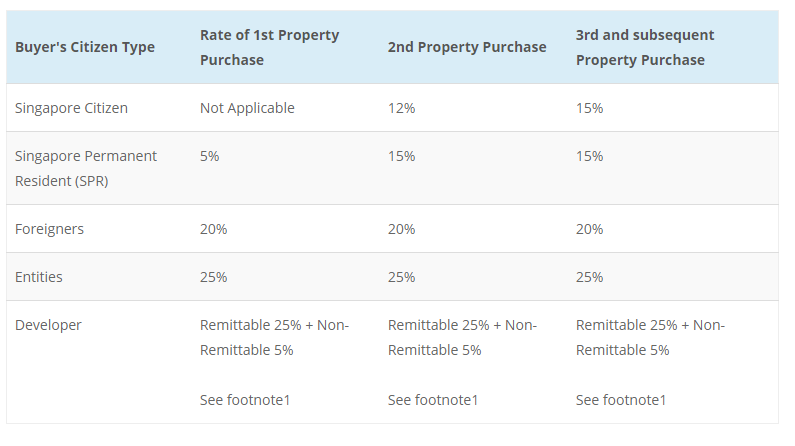

Rates on or after 6 July 2018

Footnote1:

1(a) As entities, developers will also be subject to the ABSD rate of 25% for entities. Developers may apply for remission of this 25% ABSD, subject to conditions (including completing and selling all units within the prescribed periods of 3 years or 5 years for non-licensed and licensed developers respectively). Details are provided under the Stamp Duties (Non-licensed Housing Developers) (Remission of ABSD) Rules and the Stamp Duties (Housing Developers) (Remission of ABSD) Rules.

Above table is meant for straightforward cases, whereby buying group consists of foreigners who fall under Free Trade Agreement, they may be accorded the same treatment as Singapore citizen or the buying group is made up of Singapore Citizen and Singapore Permanent Resident, a different treatment will be given. As there are many iterations, we wouldn’t be able to list them here.

Case Study on Computation of Total Buyer’s Stamp Duty

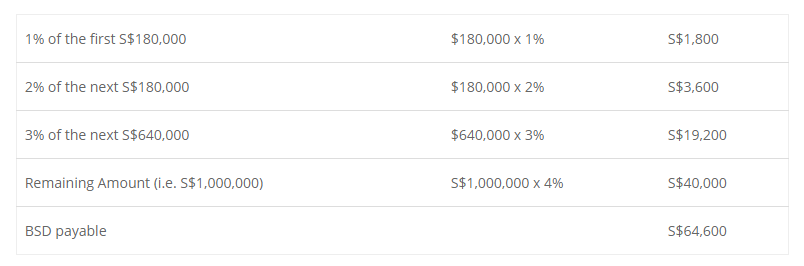

Lastly, here’s the case study for the computation of BSD and ABSD:

Assuming a foreigner buying a condominium at a market price of $3 million. The ABSD rate of 15% will apply to this particular buyer.

Computation of BSD:

Computation of ABSD (based on rates on or before 5 July 2018):

ABSD Payable: 15% on $3,000,000 = $450,000

Total Stamp Duty Payable = $64,600 + $450,000 = $514,600

Conclusion

We hope the information in this article will help you have a better understanding of the stamp duty. If you have any questions regarding stamp duty or finding a Singapore New launches Property, do not hesitate to contact us.