HDB Resale Prices Surge in Q3, Rising 2.5%; Over Half of Flats Now Sold for S$600,000 or More

Mervin Yu

Last Updated on 08-Aug-2025

The transaction volume of resale flats reached 8,035 units, marking a 20% increase compared to the same period last year. PHOTO: KEZIA KOO, BT

The Housing and Development Board (HDB) resale prices accelerated in the third quarter of 2024, increasing by 2.5% due to strong demand and limited supply. This rise follows a 2.3% increase in Q2 and surpasses the 1.3% growth recorded in the same period last year, according to HDB flash estimates released on Tuesday, October 1.

This is the fastest growth since Q3 2022, when prices rose by 2.6%, noted Christine Sun, chief researcher and strategist at OrangeTee Group. The transaction volume of resale flats surged by 20% year-on-year in Q3, reaching 8,035 units as of September 29.

Q3 is one of the strongest quarters for the public housing resale market since Q3 2021, when 8,433 resale flats were transacted, said Wong Siew Ying, head of research and content at PropNex. A record number of million-dollar transactions were recorded in Q3, with 328 deals, up from 236 in Q2 and 128 in Q1, noted Sun.

In the first nine months of the year, 747 flats were sold for over a million dollars, compared to 469 such sales in the whole of 2023. Lee Sze Teck, senior director of data analytics at Huttons Asia, expects million-dollar flat sales to likely exceed 1,000 this year.

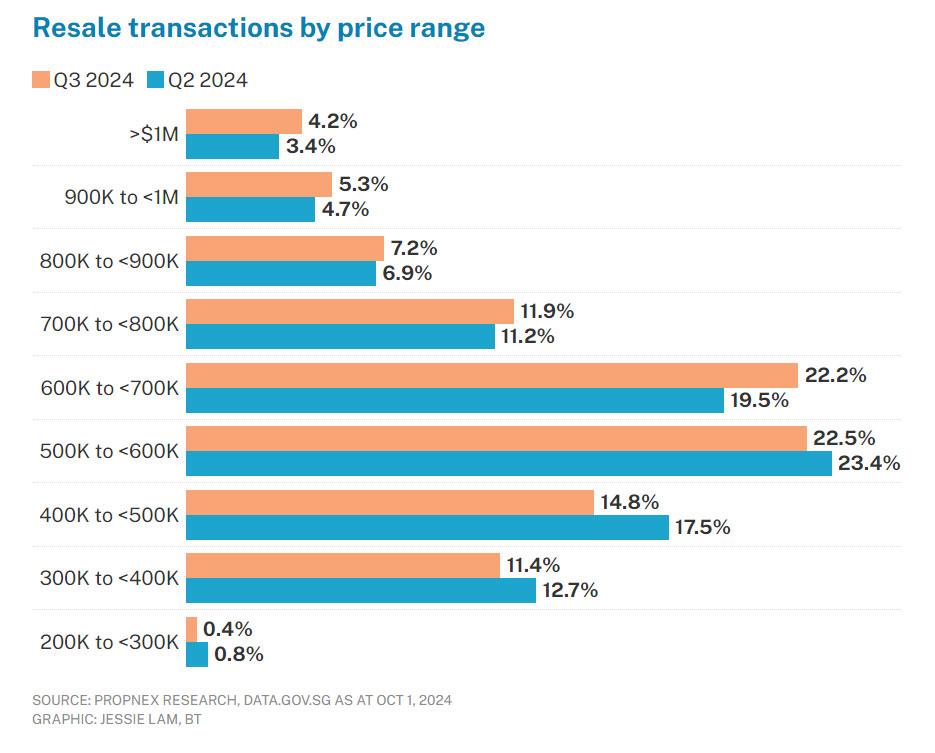

While million-dollar flats remain a small proportion of overall sales, the rest of the market is catching up. Wong from PropNex pointed out that flats sold for more than S$600,000 now account for over half of all transactions, up from 45.7% in the previous quarter.

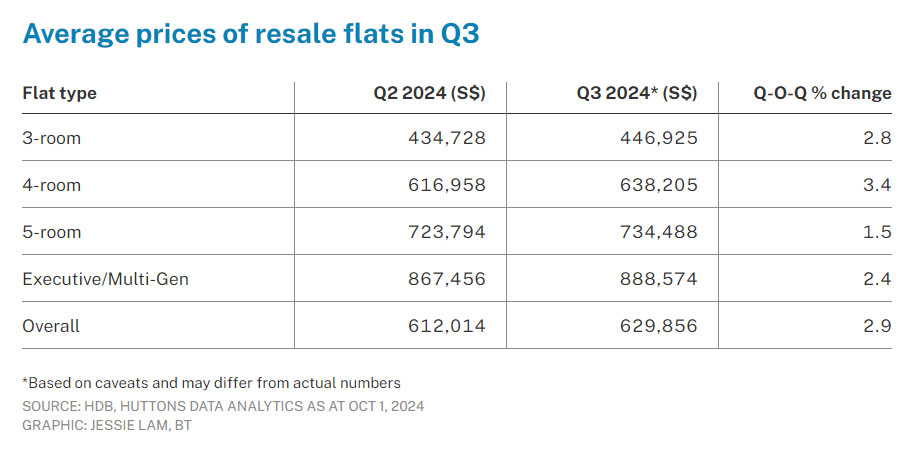

The average price of all room types rose across the board, said Lee from Huttons. Four-room flats saw the greatest average price increase at 3.4% to S$638,205, while five-room flats had the smallest increase at 1.5% to S$734,488. Overall, the average price of resale flats increased by 2.9% to S$629,856.

The Q3 jump brings price growth for the first nine months of 2024 to 6.8%, outpacing the 4.9% growth for the entire 2023. Transaction volume for the year so far stands at 22,455 units, 11.2% higher than the 20,188 units resold in the same period last year, said Lee.

Healthy Demand and Supply Squeeze

HDB attributed the rise in both resale prices and volumes to "strong broad-based demand" and supply tightness, with fewer new flats meeting the minimum occupation period (MOP) this year compared to the previous year.

The agency emphasized that Q3's figures reflect market conditions before the lowering of the loan-to-value limit for HDB loans from 80% to 75%, which was implemented on August 20 to cool the resale market and encourage greater financial prudence among homebuyers.

Lee noted that the faster pace of price growth in the first half of the year may have generated some "fear of missing out" among buyers in Q3. "With fewer listings in some HDB towns due to a lower number of newly MOP flats, some buyers felt pressured to quickly purchase a resale flat."

Mohan Sandrasegeran, head of research and data analytics at SRI, observed an uptick in demand for larger flats, particularly four and five-room flats, as well as those with leases starting from 2013 onwards, which could have pushed overall resale prices up.

Eugene Lim, key executive officer at ERA, pointed out that some HDB upgraders may have been priced out of the private market in Q3 and consequently turned to the HDB resale market. Data for non-landed private home transactions showed that the proportion of purchasers with HDB addresses fell to 28.8% in Q3, from 37.2% in Q2 and 33.8% in Q1.

"The lower number of condo upgraders likely means these homebuyers defaulted to the HDB market instead, driving transactions and prices," said Lim. "This group also has the capital and is willing to purchase million-dollar flats, leading to the rise in transactions."

More private home downgraders also fulfilled their 15-month wait-out period to buy an HDB resale flat, said Sun from OrangeTee Group.

Staying Elevated

Analysts predict that resale prices and volumes are likely to remain elevated, given the strong underlying housing demand. The impact of HDB's latest cooling measures remains to be seen.

Some potential buyers may turn to the resale market to avoid the tight conditions of the new Build-To-Order (BTO) Standard, Plus, and Prime models, said Lim from ERA. Demand will be firm and prices competitive for larger five-room and executive flats, as the upcoming Plus and Prime BTO flats do not include such layouts, he noted.

This could also result in resale flats near future Prime and Plus BTO sites fetching higher prices, since they come with a shorter MOP and less stringent selling criteria, said Sun from OrangeTee.

Lee from Huttons added that future cuts in interest rates will translate into lower borrowing costs and a higher loan quantum for buyers. "This may allow buyers to consider HDB resale flats in better locations, potentially increasing prices in the coming months."

Agencies expect resale volume to range between 26,000 and 30,000 units for 2024. Prices are forecast to show firm growth, with estimates varying from 5% to up to 10%.

Published on Oct 1, 2024