Land Betterment Charge Rates Cut by 5.4% on Average for Non-Landed Residential Use

Mervin Yu

Last Updated on 08-Aug-2025

Rates are up for landed residential, commercial, and hotel/hospital use groups; no change for industrial use group.

Against the backdrop of cautious bids from developers for private residential sites at state tenders, the authorities have chopped the land betterment charge (LBC) rates for non-landed residential use by 5.4 per cent on average for the next half year.

This marks the biggest cut in the LBC rate for this use group since the 5.5 per cent decrease in March 2019.

Developers pay an LBC for the right to enhance the use of some sites or to build bigger projects on them.

The rates are announced twice a year, on Mar 1 and Sep 1, following a review by the Singapore Land Authority, in consultation with the taxman’s chief valuer (CV).

The LBC rates are based on the CV’s assessment of land values and take into consideration recent land sales. They are stated according to use groups across 118 geographical sectors in Singapore.

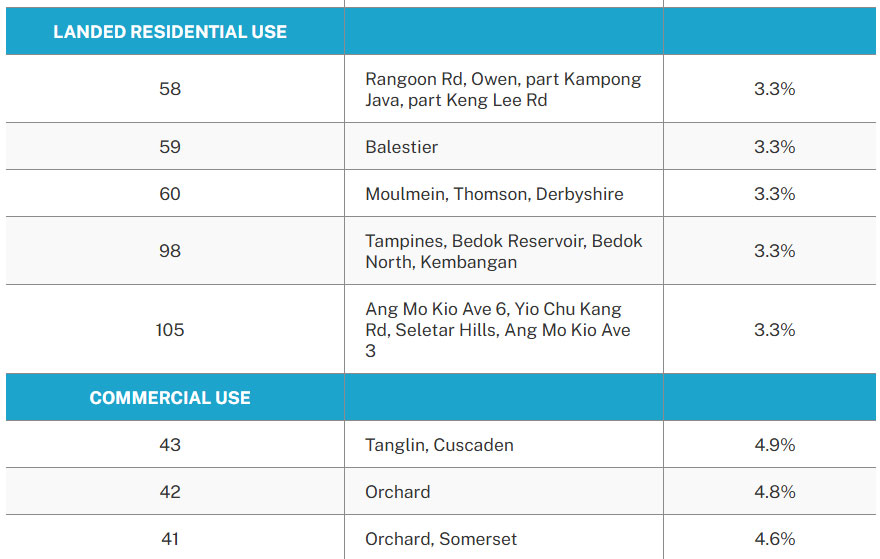

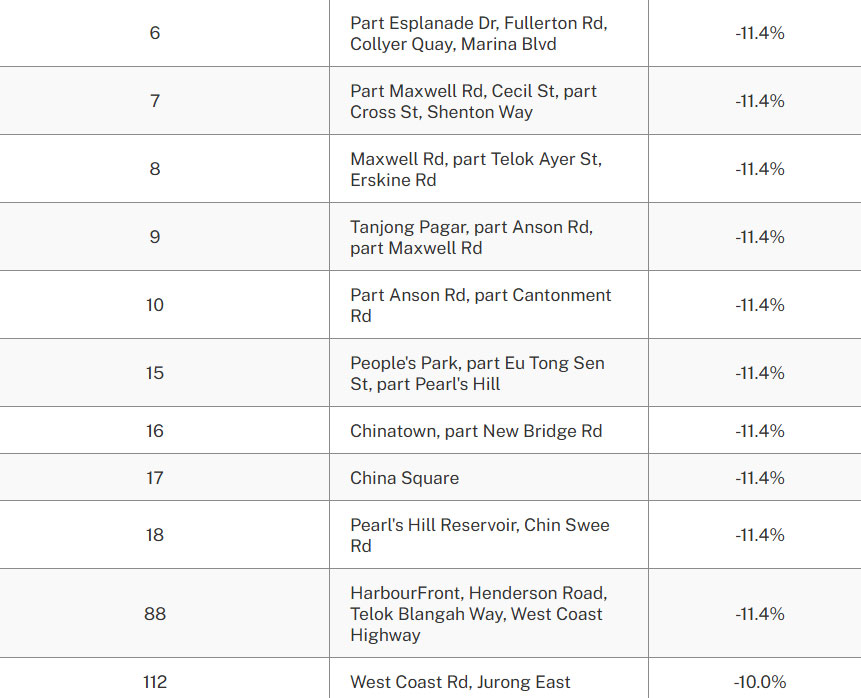

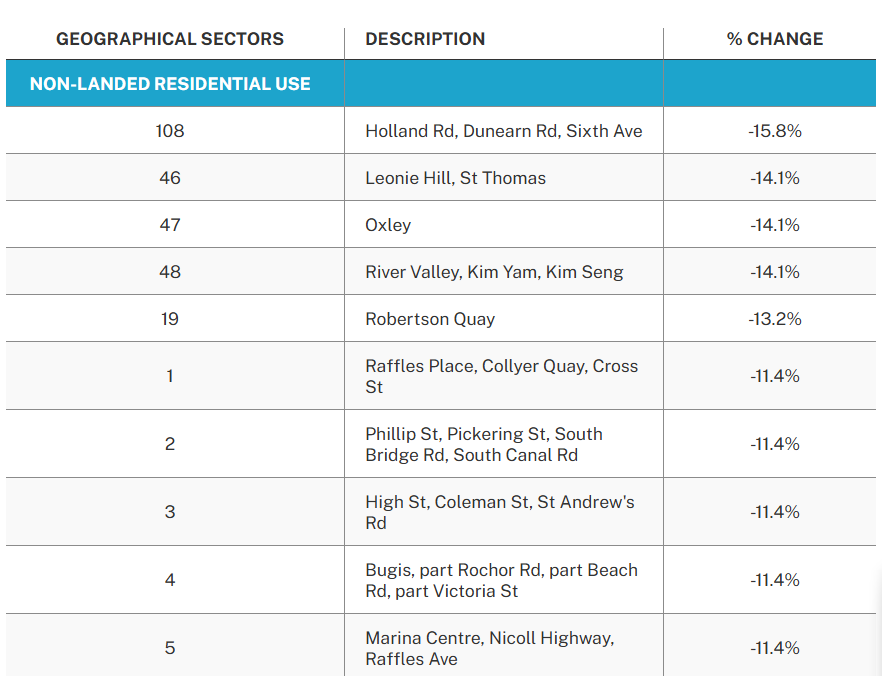

In the latest announcement on Friday, the cuts to LBC rates for non-landed residential use were broad based, with 116 geographical sectors seeing decreases ranging from 2 per cent to nearly 16 per cent. There are no changes for the remaining two sectors.

According to JLL’s analysis, the biggest drop of 15.8 per cent was for sector 108, which includes the Holland Road, Dunearn Road and Sixth Avenue areas. Located in this sector is the Margaret Drive private housing site offered at a state tender that closed on Aug 1.

The winning bid of S$1,154 per square foot per plot ratio (psf ppr) works out to 29 per cent below the implied land value based on the Mar 1, 2024, LBC rate for non-landed residential use for the sector.

Mogul.sg chief research officer Nicholas Mak said the decline in non-landed residential LBC rates is “not surprising, as property developers have submitted conservative bids in recent state land tenders and the government was willing to sell the land at prices that were lower than comparable land parcels in the vicinity”.