Private Home Price Growth Slows in Q2 2025 | URA Flash Estimates

Mervin Yu

Last Updated on 08-Aug-2025

Singapore Private Home Price Growth Slows Further in Q2 2025

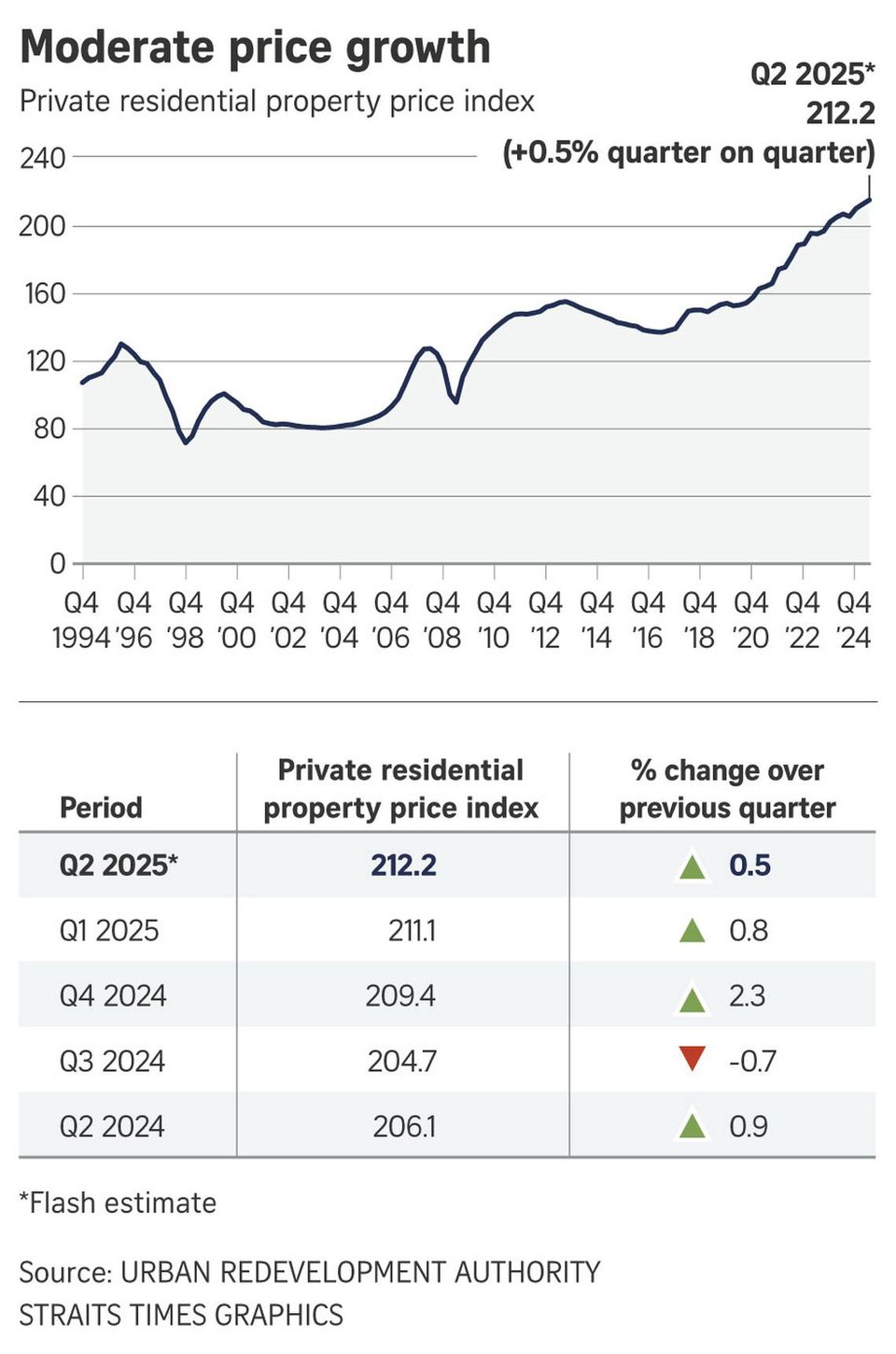

SINGAPORE – Growth in private residential property prices in Singapore continued to moderate in the second quarter of 2025, according to flash estimates released by the Urban Redevelopment Authority (URA) on July 1. The private residential property price index rose by 0.5% in Q2 2025, slowing from the 0.8% growth recorded in Q1.

Alongside the softer price increase, the sales transaction volume declined sharply, with only 4,340 private homes sold in Q2—down from 7,261 units in Q1, marking a steep 40% quarter-on-quarter fall. The URA attributed this drop to a lower number of new launches during the quarter.

Mixed Price Movements Across Property Segments and Regions

Non-landed property prices saw a modest rise of 0.5%, following a 1% increase in the first quarter. However, price trends varied across regions:

- Core Central Region (CCR): Prices rose by 2.3%, accelerating from a 0.8% increase in Q1.

- Rest of Central Region (RCR): Prices declined by 1.1%, reversing a 1.7% gain in the previous quarter.

- Outside Central Region (OCR): Prices increased by 0.9%, up from a 0.3% rise in Q1.

- Landed Properties: Prices rose by 0.7%, following a 0.4% increase in Q1.

These figures reflect growing buyer caution and mixed demand across different market segments, as both developers and consumers navigated economic headwinds and seasonal factors.

Global Uncertainty and Local Events Affect Market Sentiment

Analysts attributed the slowdown in price growth to several factors. ERA Singapore CEO Marcus Chu noted that April’s general elections and the June school holidays dampened new launch activity. Mohan Sandrasegeran from Singapore Realtors Inc. pointed to US trade tariffs and broader global uncertainty as key reasons why developers delayed launches.

In addition, Knight Frank Singapore's Leonard Tay said more buyers have adopted a “watch-and-wait” attitude in recent months. Realion Group's Christine Sun echoed these sentiments, citing geopolitical tensions in the Middle East and global trade worries as reasons for buyer caution. However, she noted that projected falling interest rates in the second half of 2025 may improve affordability and spur fresh demand.

Looking Ahead: Market Stabilization and URA’s Draft Master Plan

Despite the slowdown, analysts remain cautiously optimistic about the second half of 2025. Mr. Sandrasegeran expects the market to benefit from upcoming project launches tied to the URA Draft Master Plan 2025, announced on June 25. The plan includes new housing and amenities in areas like Newton and Paterson, potentially boosting future demand.

Nicholas Mak from Mogul.sg added that the easing pace of price growth could reduce the likelihood of additional property cooling measures. The current measures already include the 60% Additional Buyer’s Stamp Duty (ABSD) for foreigners introduced in April 2023.

Housing Supply and Price Outlook for 2025

To meet demand and support long-term market stability, URA confirmed it will maintain a “high level of private housing supply.” On June 24, it announced that 4,725 private residential units will be launched in H2 2025 under the confirmed list, bringing the total confirmed supply for the year to nearly 10,000 units.

Looking ahead, Leonard Tay expects private home prices to stabilize in the second half of the year, with full-year price growth likely in the range of 3% to 5%. Mr. Sandrasegeran offered a slightly higher forecast of 3% to 6%, reflecting a balance between global risks, steady local demand, and the government’s calibrated land release strategy.

Conclusion

The Singapore private property market remains resilient despite external uncertainties. While Q2 2025 saw slower price growth and lower sales volumes, upcoming launches, supportive policies, and easing interest rates are expected to sustain buyer interest and maintain a healthy market trajectory.