Wing Tai Leads with S$1,325 psf ppr Bid for Site Adjacent to Great World City

Mervin Yu

Last Updated on 08-Aug-2025

The outcome aligns with market forecasts, signaling ongoing prudence among developers due to increased

business risks. The recent government land sale indicates a continued subdued interest in private residential plots,

exacerbated by high interest rates and regulatory cooling measures.

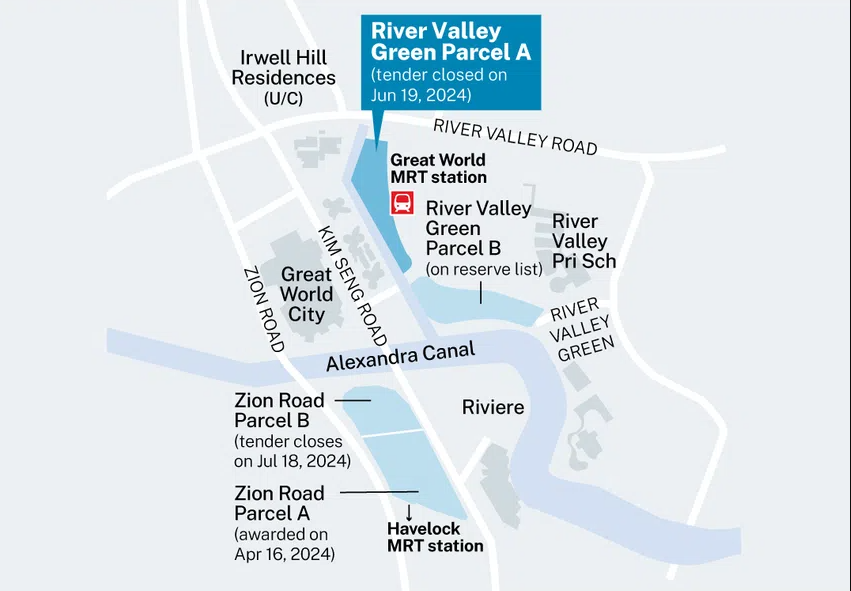

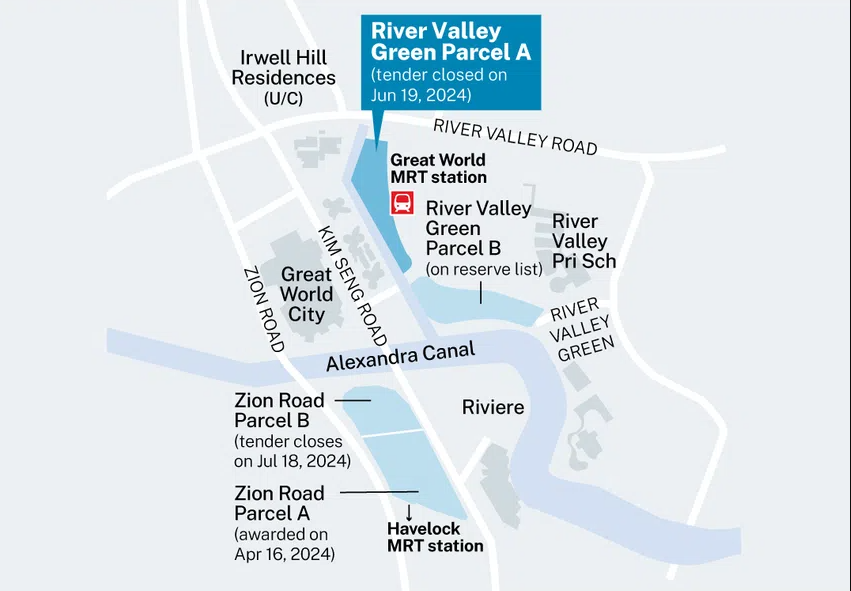

A coveted 99-year leasehold site near Great World City attracted two bids, while a plot on Upper Thomson Road, mandated to include long-stay serviced apartments, received none. Both plots are leasehold for 99 years and conveniently located beside Thomson-East Coast Line MRT stations.

"Given the premium location, the new development on River Valley Green (Parcel A) is expected to cater to investors and foreigners, sectors recently impacted by the Additional Buyer's Stamp Duty (ABSD) increase in April 2023," stated Tricia Song from CBRE.

Wing Tai Holdings submitted a nearly S$464 million bid, translating to S$1,325 per square foot per plot ratio (psf ppr), for the site adjacent to Great World MRT station. Hong Realty, part of the Hong Leong Group, offered a close S$444.89 million or S$1,271 psf ppr.

The River Valley Green (Parcel A) site spans 100,032 sq ft and is projected to yield approximately 380 private residences.

"The tepid response to this tender reflects a cautious stance from developers, who prefer smaller plots," observed Chia Siew Chuin, JLL's residential research lead in Singapore.

Wing Tai's bid is 12.5% lower than the S$1,515 psf ppr paid by City Developments for a nearby site on Irwell Bank Road in January 2020, which is now being developed into Irwell Hill Residences, exclusively for residential use.

Market analysts highlight a general deceleration in new private home sales and local supply concerns as influencing factors at the tender closing on June 19.

Concerns Over Housing Demand Depth

"Buyers are increasingly discerning this year, as seen in the uneven success of new launches. With growing price sensitivity, they are more judicious in their selections," remarked Leonard Tay, head of research at Knight Frank Singapore.

Wong Siew Ying, PropNex's research and content lead, anticipates continued developer caution due to potential uncertainties regarding the depth of private housing demand, following a slowdown in sales in 2023 and a subdued transaction volume in recent months amidst a scarcity of project launches.

"Developers are also weighing the impact of the upcoming projects and the substantial unit supply from the first-half 2024 Government Land Sales (GLS) program," Wong added.

Competing Supply Despite Prime Location

Despite its prime location—next to an MRT station, close to Great World City mall, and River Valley Primary School—the new project on River Valley Green (Parcel A) will compete with imminent new developments.

Wong highlighted the approximately 1,780 residential units forthcoming from Zion Road Parcels A and B, which include around 435 long-stay serviced apartments on Parcel A, awarded in April. Parcel B, solely for residential use, was released from the GLS program's reserve list, with its tender closing on July 18.

Further potential competition could arise if River Valley Green Parcel B, currently on the reserve list, is activated. This plot could contribute 580 residential units, including about 220 long-stay serviced apartments.

"There's likely to be heightened interest in the second-half 2024 GLS program for alternative sites," noted Justin Quek, CEO of OrangeTee & Tie.

Tricia Song of CBRE suggested that developers' caution towards River Valley Green (Parcel A) might stem from its central location and the expectation of a high-end project targeting investors and foreigners—groups significantly affected by last year's ABSD rate increases. Song anticipates the development could command an average selling price of S$3,000 psf.

Complex construction considerations due to the site's irregular shape and proximity to Great World MRT station may have also deterred developers, according to Leonard Tay of Knight Frank.

The Business Times' surveyed property consultants had predicted one to four bids for the plot, with the top bid ranging between S$1,200-1,400 psf ppr.

The received bids surpassed the S$1,202 psf ppr achieved by Zion Road (Parcel A) in April, despite the latter's mixed residential and commercial zoning and mandatory long-stay serviced residence component.

Adapted from The Business Times