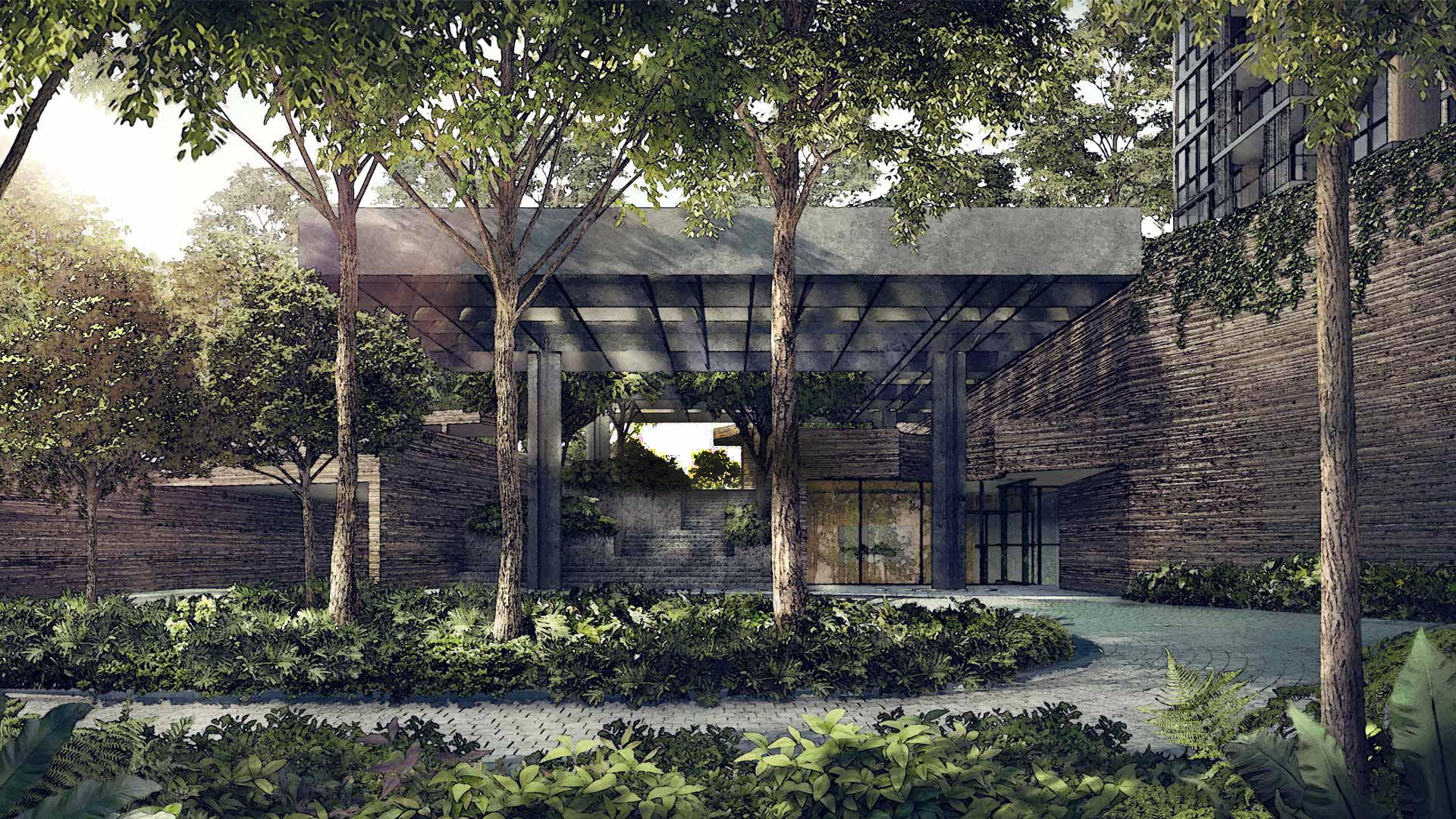

Arena Residences Showflat

Showflat viewing will be coming soon, please CALL US or FILL IN THE FORM to stay updated!

5 Things Before Your Visit Areana Residences showflat

Before visiting the Arena Residences showflat, there are some important information you should know regarding your financial position and abilities. Your actual purchasing power is not limited to the income you get at the end of every month but it is also dependent on the number of assets under your name. Besides, the maximum eligible loan caps that are set by the banks do not dictate the amount of loans you can borrow but by your maximum monthly financial commitments. Therefore, it is very crucial for any potential property buyer to understand such facts before visiting a showflat.

Below are the 5 Things to consider Before You tour Arena Residences Showflat:

1. Your Central Provident Fund (CPF) Usage

This depends whether you are first time or subsequent property buyer. If you are buying the property for the first time, the maximum amount of CPF you may utilize is all the funds in your Ordinary Account (OA). On the other hand, of you are buying a second asset, you must meet the minimum required total of $75,000 in both your OA and the Special Account (SA).

2. Loan-Approval-In Principal (AIP)

This is another crucial aspect that most of the property buyers ignore. It is a very important thing you should have before thinking of buying any property as it will guide you when setting the property buying budget. When you have your AIP, you will be in a position to know the amount the bank can loan you for the property purchase. It is free to do it and takes about 3 working days for the lending bank to process your request.

The documents you need include: copy of passports for the purchasers, dully filled application form, HDB page, latest three months payslip, recent one year CPF contribution, recent one year IRAS Tax Assessment Return, Declaration of all credit facilities and statements of all your credit cards used.

3. Know Your Additional Buyer Stamp Duty (ABSD) Bracket

In today’s market, this is another key element to be considered. Singapore residents, your first property is free from ABSD. However, when you buy your second and the third properties, they will be taxed at a rate of 7% and 10% on the buying price respectively. For the permanent residents, the first property you buy will be taxed at a rate of 5% of the buying price. The subsequent properties you buy will be taxed at the rate of 10% of the buying price. Finally, entities and foreigners will be taxed at the rate of 15% of the buying price of the property.

4. Knowing Normal Progressive Payment Scheme (NPS)

This is the current payment scheme that is used in most condominium projects. It is important to know the payment progression as it will assist you to plan the cash flow for the asset purchase. After choosing your unit and has been confirmed:

- You pay 5% in cash to the project account of your developer so as to get OTP (Option to Purchase).

- After two weeks, the developer sends sales and the purchase agreement to your account. When you receive it, you exercise the contract to your solicitor’s office within three weeks.

- In case contract is not exercised, you will be paid 75% of the fee paid. ABSD and Stamp duty will be payable after 14 days in case the agreement is exercised. Finally, remaining 15% of initial down payment will be paid within two months from the initial OTP date.