Private house prices down 0.2% in Q2, rent growth slows.

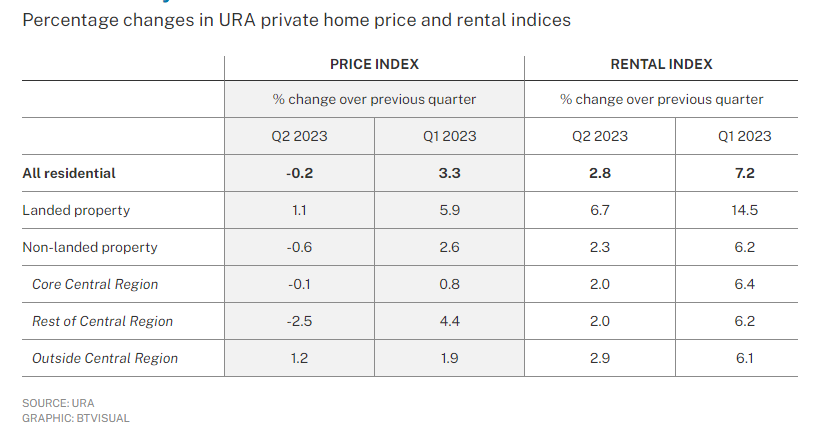

Urban Redevelopment Authority (URA) data that caused a stir on Friday morning (July 28) showed that the private house index for the second quarter fell 0.2 per cent, well below the decline of zero. .4% in a quick estimate published earlier this month.

But arguably the biggest takeaway from the latest URA data on the Singapore private housing market is that rent growth has slowed considerably. URA's overall private home rental index grew 2.8% in Q2 2023 from the previous quarter. This is a smaller rate than the 7.2% quarterly (qoq) increase in the first quarter of this year.

Overall private housing rents have increased 10.2% from the fourth quarter of last year and are up 57.2% since bottoming in the third quarter of 2020.

Some real estate consultants are predicting rent adjustments in the second half of the year. CBRE Research expects property rents to fall 5% in the second half of 2023, with a full-year increase of 5%.

Sharing the same view, Edmund Tie's head of research and consulting, Lam Chern Woon, said: "Rent is likely to correct in the second half of the year, but will still see growth between 5% and 5%. 10% for the full year, after a massive 29.7% increase in 2022.”

Tricia Song, head of Southeast Asia research at CBRE, said: “Based on URA Realis rental data downloaded in mid-July, we note that average rents for private residences are on the rise. The island-wide landless population peaked in April 2023, then gradually declined by 3.9 percent in June. The drop was led by the Core Central Area (CCR).”

URA data shows that the pace of private housing completions picked up in the second quarter of 2023, with 4,401 homes completed, compared with 2,965 completed in the previous quarter.

The vacancy rate rose 0.3 percentage points from the previous quarter to 6.3%, the highest level in nearly two years, said Edmund Tie's Lam.

According to URA data based on expected completion dates reported by developers, about 11,810 single-family homes are expected to be completed in the second half of this year, followed by another 8,959 next year.

“This will inject a significant amount of stock into the market and alleviate the supply shortage. In addition, we note that demand from expats has slowed and owners who are temporarily displaced are moving into their newly completed homes,” said Song.

URA data also showed a 6.7% increase in land rents from the previous quarter, down slightly from the 14.5% increase in Q1.

The increase in rents for non-land properties fell to 2.3%, from a previous increase of 6.2%. URA said that the momentum for renting single-family homes without land has eased across all regions.

If you are interested in this new launch condo, discover more about projects details here!!!

About that price index drop

Regarding the URA's overall home price index showing a smaller drop on Friday than the flash four weeks earlier, Knight Frank Singapore head of research, Leonard Tay, said: saw sales at new sales in the past weeks have created some uptrend. support, as demand from local homebuyers remains stable.”

The price index fell 0.2% quarter-on-quarter, breaking a three-year growth streak, as PropNex's Wong Siew Ying noted.

Overall, New Launch Condo prices in the second quarter of this year increased by 3.1% compared to the fourth quarter of last year, and real estate consultants predict a full-year increase in 2023 to be in the range of 2% to 6%.

The price decline in Q2 was led by a 2.5% quarter-over-quarter drop in the price of single-family homes in the suburbs or Rest of the Central Region (RCR). This contrasts with a 4.4 percent increase in the previous quarter.

Wong Xian Yang, head of Singapore and Southeast Asia research at Cushman & Wakefield, said: “We think the sharp drop in RCR prices is not a signal of weaker market demand but rather volatility. of the new RCR selling price. may vary depending on the number and combination of new launches launched during the quarter.

In the aftermath of the property cooling measures at the end of April, doubling to 60% of the Additional Buyer Stamp Tax Rate for foreigners purchasing any residential property in Singapore, The purchasing power of foreigners has decreased.

PropNex Realty CEO Ismail Gafoor said the percentage of new single-family homes without land purchased by foreigners fell to a more than one-year low of around 5.2% in the second quarter of 2023. In contrast, The percentage of new homes bought by Singaporeans was near a two-year high of 84.6% in Q2 2023, according to URA Realis foreshadowing data.

“In terms of absolute value, 109 landless homes were purchased by foreigners in the second quarter of 2023; Of these, 26 are from the US and 19 from China,” he added.

In the primary market, private home sales by developers increased 69% q-o-q to 2,127 units in the second quarter of 2023, continuing the upward trend.

According to URA data based on the expected completion dates reported by developers, some 11,810 private homes are projected to be completed in H2 this year, followed by a further 8,959 units next year.

“This would inject a significant amount of stock into the market and alleviate the tight supply situation. In addition, we note expatriate demand has slowed and temporarily displaced owners are moving into their newly completed homes,” said Song.

URA’s data also showed that rentals of landed homes climbed 6.7 per cent qoq in Q2, moderating from the 14.5 per cent increase in Q1.

The increase in the rentals of non-landed properties slowed to 2.3 per cent, from the 6.2 per cent gain previously. The rental momentum for non-landed private homes eased across all regions, URA said.

For more latest news on New Condo Launches and don't forget to follow our website and get the chance to live in these amazing luxury residences!

Email

Email

Sms

Sms

Whatsapp

Whatsapp